04Q24 QUARTERLY M&A REPORT

Research

All Standard Disclaimers Apply & Seller Rights Retained

DEAL PERSPECTIVES (MEDIA VERSION)

Quick 9 Pages of the Full 25 Page Report

$9.6B IN 4Q24 - DOWN FROM $12.5B IN 3Q

$105B in 2024 Versus Record $192B in 2023

Average is $83B per Year since 2015

Record Low 11 Deals in 4Q

Average is 40 Deals per Quarter since 2015

Biggest Deal is Coterra's $3.95B Delaware

FourPoint Buys OVV's Uinta for $2.0B

CRGY Vaults to EF's #2 and #3 Gas & Oil Op.

Equinor Buys EQT's Marcellus Non-OP

Globally, Energy Deals of $263 B in 2024

Expect 2025 Trend Up Over 4Q 2024

Utica's Infinity Completes IPO in Jan. 2025

P/E Firms Increasingly on the Buy Side

CONTACT EAG FOR FULL 25 PAGE REPORT

STUDY 1006MA

THIS IS THE ABBREVIATED MEDIA VERSION

Energy Advisors Group has released a Q4 2024 Special Report on the U.S. A&D marketplace as a continuation of our Market Monitor Series and thought leadership efforts. The full 25-page Special Report provides perspectives on past and current trends in deal values, counts, plays and valuations.

Energy Advisors Group has over 35 years of experience assisting clients navigate the marketplace to maximize their portfolios as advisors on both the sell and buy side. Energy Advisors also provides consulting services including asset management and optimization.

Here are our quick quotes, and takeaways from our report.

Quick Quotes:

------- How was the fourth quarter? “It might have been the slowest quarterly deal market ever. That said, there were some meaningful buys from Equinor, Crescent, Coterra and FourPoint."

------- Oil dominates deal flow: "Oil deals dominated the market with public companies buying privates.”

------- Metrics: "Current economic ratio of 15:1 with market multiples of $47,000 ppbo/d and $3,150 ppmcf/d.”

------- SEC: "Per NSAI, year-end 2024 price basis for public company reserves will be based on WTI spot of $76.36 and HH spot of $2.20 held flat.”

------ Globally: "Upstream, 4Q24 was up to $18.4 billion, driven by a resurgence in Canada with $8.0 billion. Internationally, upstream deal flow was virtually nil from a historic quarterly average of ~$8.0 billion”

Takeaways from 4Q 2024---

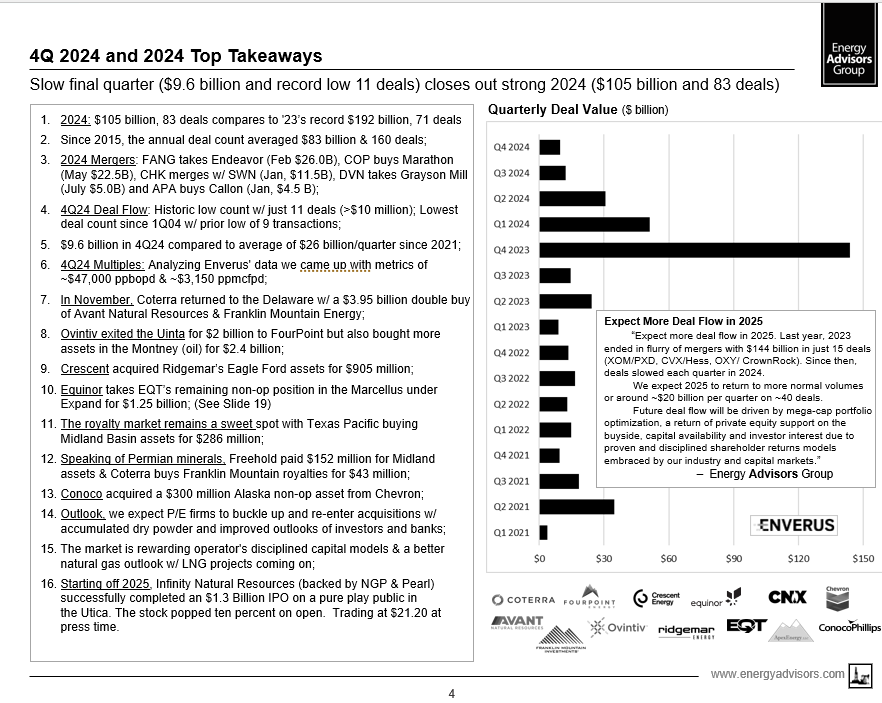

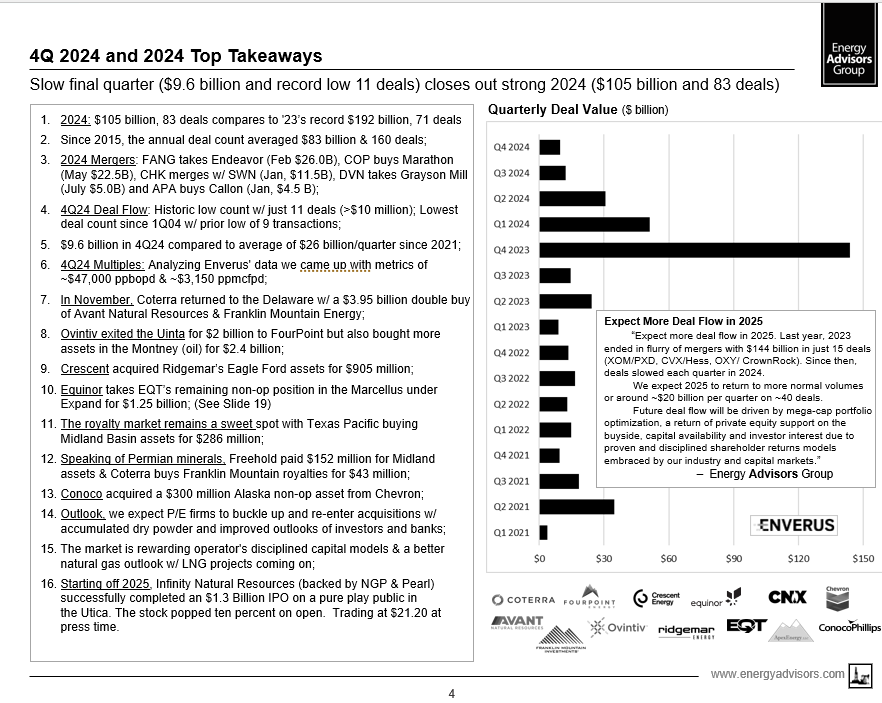

- 2024: $105 billion, 83 deals compares to '23’s record $192 billion, 71 deals

- Since 2015, the annual deal count averaged $83 billion & 160 deals;

- 2024 Mergers: FANG takes Endeavor (Feb $26.0B), COP buys Marathon (May $22.5B), CHK merges w/ SWN (Jan, $11.5B), DVN takes Grayson Mill (July $5.0B) and APA buys Callon (Jan, $4.5 B);

- 4Q24 Deal Flow: Historic low count w/ just 11 deals (>$10 million); Lowest deal count since 1Q04 w/ prior low of 9 transactions;

- $9.6 billion in 4Q24 compared to average of $26 billion/quarter since 2021;

- 4Q24 Multiples: Analyzing Enverus' data we came up with metrics of ~$47,000 ppbopd & ~$3,150 ppmcfpd;

- In November, Coterra returned to the Delaware w/ a $3.95 billion double buy of Avant Natural Resources & Franklin Mountain Energy;

- Ovintiv exited the Uinta for $2 billion to FourPoint but also bought more assets in the Montney (oil) for $2.4 billion;

- Crescent acquired Ridgemar’s Eagle Ford assets for $905 million;

- Equinor takes EQT’s remaining non-op position in the Marcellus under Expand for $1.25 billion; (See Slide 19)

- The royalty market remains a sweet spot with Texas Pacific buying Midland Basin assets for $286 million;

- Speaking of Permian minerals, Freehold paid $152 million for Midland assets & Coterra buys Franklin Mountain royalties for $43 million;

- Conoco acquired a $300 million Alaska non-op asset from Chevron;

- Outlook, we expect P/E firms to buckle up and re-enter acquisitions w/ accumulated dry powder and improved outlooks of investors and banks;

- The market is rewarding operator's disciplined capital models & a better natural gas outlook w/ LNG projects coming on;

- Starting off 2025, Infinity Natural Resources (backed by NGP & Pearl) successfully completed an $1.3 Billion IPO on a pure play public in the Utica. The stock popped ten percent on open. Trading at $21.20 at press time.

#1---

Here is additional insight from the report taken from one of our slides:

#2---

Here is some additional content:

#3---

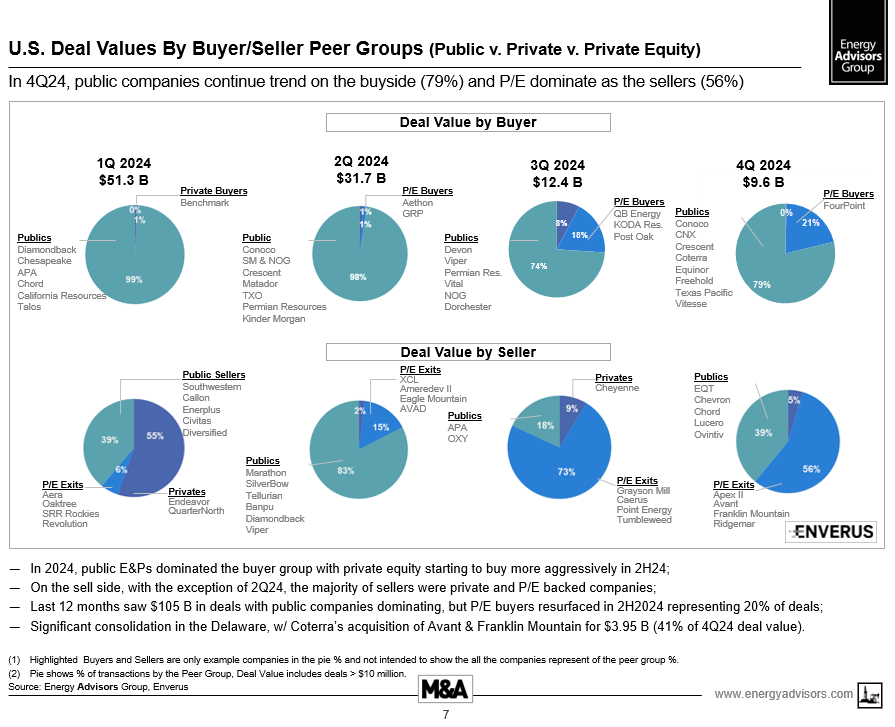

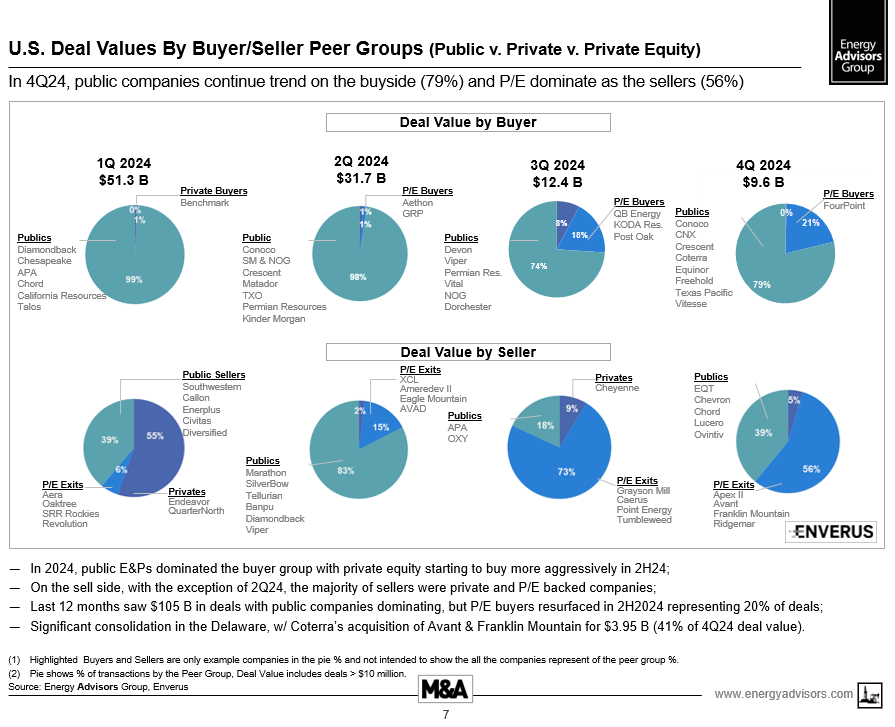

Here is a striking slide demonstrating public companies dominating the buyside:

The 9-page media report is available to the right.

Interested parties desiring to see the whole 26 page report should email any one of us down below for the complete version.

Energy Advisors Group is working hard to expand our thought leadership and look forward to providing additional market insight for our clients through regional perspectives, M&A analysis and market monitor.

Our firm has been serving the needs of buyers, sellers and capital providers for over thirty-five years.

TO LEARN MORE AND RECIEVE A COPY OF THE FULL REPORT CONTACT:

Blake Dornak

Vice President

Phone: 713-600-0169

– Email: bdornak@energyadvisors.com

Simon Cohn

Sr. A&D Engineer

-- Email:scohn@energyadvisors.com

Brian Lidsky

Director

Phone: 713-600-0138

– Email: blidsky@energyadvisors.com

Ronyld W Wise

Founder & Managing Partner

-- Email rwise@energyadvisors.com

Corporate Office:

4265 San Felipe Ste 650

Houston TX 77027

Corporate Switchboard: 713-600-0123

DEAL PERSPECTIVES (MEDIA VERSION)

Quick 9 Pages of the Full 25 Page Report

$9.6B IN 4Q24 - DOWN FROM $12.5B IN 3Q

$105B in 2024 Versus Record $192B in 2023

Average is $83B per Year since 2015

Record Low 11 Deals in 4Q

Average is 40 Deals per Quarter since 2015

Biggest Deal is Coterra's $3.95B Delaware

FourPoint Buys OVV's Uinta for $2.0B

CRGY Vaults to EF's #2 and #3 Gas & Oil Op.

Equinor Buys EQT's Marcellus Non-OP

Globally, Energy Deals of $263 B in 2024

Expect 2025 Trend Up Over 4Q 2024

Utica's Infinity Completes IPO in Jan. 2025

P/E Firms Increasingly on the Buy Side

CONTACT EAG FOR FULL 25 PAGE REPORT

STUDY 1006MA

THIS IS THE ABBREVIATED MEDIA VERSION

Energy Advisors Group has released a Q4 2024 Special Report on the U.S. A&D marketplace as a continuation of our Market Monitor Series and thought leadership efforts. The full 25-page Special Report provides perspectives on past and current trends in deal values, counts, plays and valuations.

Energy Advisors Group has over 35 years of experience assisting clients navigate the marketplace to maximize their portfolios as advisors on both the sell and buy side. Energy Advisors also provides consulting services including asset management and optimization.

Here are our quick quotes, and takeaways from our report.

Quick Quotes:

------- How was the fourth quarter? “It might have been the slowest quarterly deal market ever. That said, there were some meaningful buys from Equinor, Crescent, Coterra and FourPoint."

------- Oil dominates deal flow: "Oil deals dominated the market with public companies buying privates.”

------- Metrics: "Current economic ratio of 15:1 with market multiples of $47,000 ppbo/d and $3,150 ppmcf/d.”

------- SEC: "Per NSAI, year-end 2024 price basis for public company reserves will be based on WTI spot of $76.36 and HH spot of $2.20 held flat.”

------ Globally: "Upstream, 4Q24 was up to $18.4 billion, driven by a resurgence in Canada with $8.0 billion. Internationally, upstream deal flow was virtually nil from a historic quarterly average of ~$8.0 billion”

Takeaways from 4Q 2024---

- 2024: $105 billion, 83 deals compares to '23’s record $192 billion, 71 deals

- Since 2015, the annual deal count averaged $83 billion & 160 deals;

- 2024 Mergers: FANG takes Endeavor (Feb $26.0B), COP buys Marathon (May $22.5B), CHK merges w/ SWN (Jan, $11.5B), DVN takes Grayson Mill (July $5.0B) and APA buys Callon (Jan, $4.5 B);

- 4Q24 Deal Flow: Historic low count w/ just 11 deals (>$10 million); Lowest deal count since 1Q04 w/ prior low of 9 transactions;

- $9.6 billion in 4Q24 compared to average of $26 billion/quarter since 2021;

- 4Q24 Multiples: Analyzing Enverus' data we came up with metrics of ~$47,000 ppbopd & ~$3,150 ppmcfpd;

- In November, Coterra returned to the Delaware w/ a $3.95 billion double buy of Avant Natural Resources & Franklin Mountain Energy;

- Ovintiv exited the Uinta for $2 billion to FourPoint but also bought more assets in the Montney (oil) for $2.4 billion;

- Crescent acquired Ridgemar’s Eagle Ford assets for $905 million;

- Equinor takes EQT’s remaining non-op position in the Marcellus under Expand for $1.25 billion; (See Slide 19)

- The royalty market remains a sweet spot with Texas Pacific buying Midland Basin assets for $286 million;

- Speaking of Permian minerals, Freehold paid $152 million for Midland assets & Coterra buys Franklin Mountain royalties for $43 million;

- Conoco acquired a $300 million Alaska non-op asset from Chevron;

- Outlook, we expect P/E firms to buckle up and re-enter acquisitions w/ accumulated dry powder and improved outlooks of investors and banks;

- The market is rewarding operator's disciplined capital models & a better natural gas outlook w/ LNG projects coming on;

- Starting off 2025, Infinity Natural Resources (backed by NGP & Pearl) successfully completed an $1.3 Billion IPO on a pure play public in the Utica. The stock popped ten percent on open. Trading at $21.20 at press time.

#1---

Here is additional insight from the report taken from one of our slides:

#2---

Here is some additional content:

#3---

Here is a striking slide demonstrating public companies dominating the buyside:

The 9-page media report is available to the right.

Interested parties desiring to see the whole 26 page report should email any one of us down below for the complete version.

Energy Advisors Group is working hard to expand our thought leadership and look forward to providing additional market insight for our clients through regional perspectives, M&A analysis and market monitor.

Our firm has been serving the needs of buyers, sellers and capital providers for over thirty-five years.

TO LEARN MORE AND RECIEVE A COPY OF THE FULL REPORT CONTACT:

Blake Dornak

Vice President

Phone: 713-600-0169

– Email: bdornak@energyadvisors.com

Simon Cohn

Sr. A&D Engineer

-- Email:scohn@energyadvisors.com

Brian Lidsky

Director

Phone: 713-600-0138

– Email: blidsky@energyadvisors.com

Ronyld W Wise

Founder & Managing Partner

-- Email rwise@energyadvisors.com

Corporate Office:

4265 San Felipe Ste 650

Houston TX 77027

Corporate Switchboard: 713-600-0123