PERMIAN (DB) REGIONAL STUDY V2

Research

All Standard Disclaimers Apply & Seller Rights Retained

DELAWARE BASIN REPORT - Vol 2

February 28, 2025; 48-Page Report

DELAWARE BASIN

M&A, E&P, Capital Markets, Operations

STACKED PAY. BONE SPRING & WOLFCAMP

>25,000-Horizontal Wells. 10,000 Verticals.

~160 RIGS RUNNING.

2,341-Drill Permits Issued Last 6 Months

1,885-DUCs Pending

Gross Production: 3.2 MMBopd & 14.8 Bcfpd

Delaware Reported $9 B in M&A, 8.5% Market

P/E Exits While Public Companies Buying

Report Incl List & Map of P/E & Private Cos.

DOWNLOAD THIS REGIONAL REPORT

STUDY 3002MA

Energy Advisors Group has released a review of the Delaware Basin as a continuation of our Market Monitor Series and thought leadership efforts. This 48-page Special Report provides unique perspectives on M&A, E&P and Capital Markets activity in the play. This report also includes a list of the remaining Delaware private and P/E backed companies with meaningful production as these companies dwindle in numbers by acquisitions from publics.

Here are our quick quotes, and takeaways from our report.

Quick Quotes:

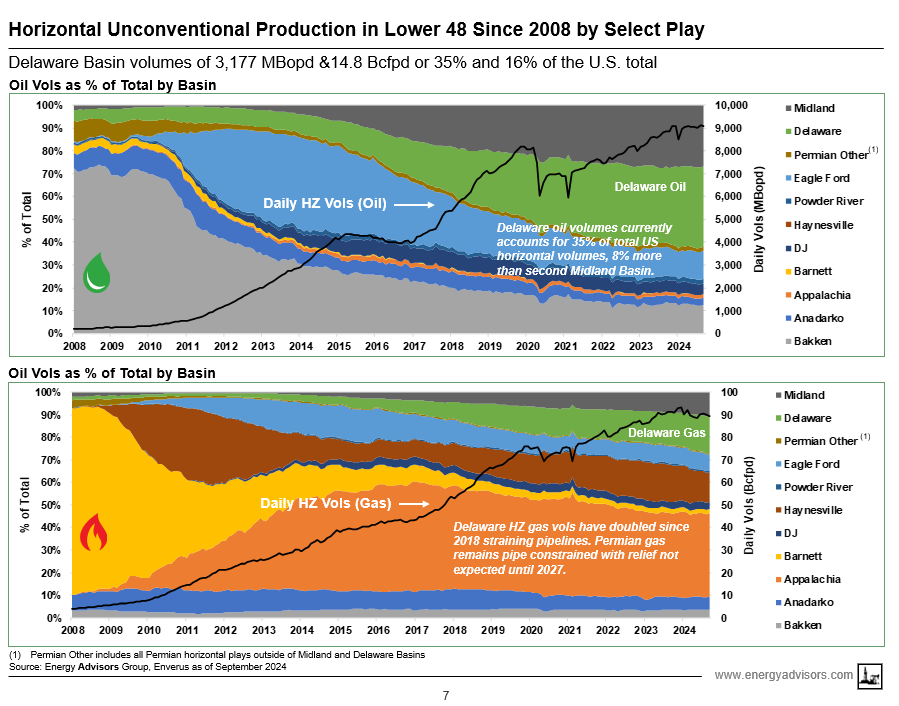

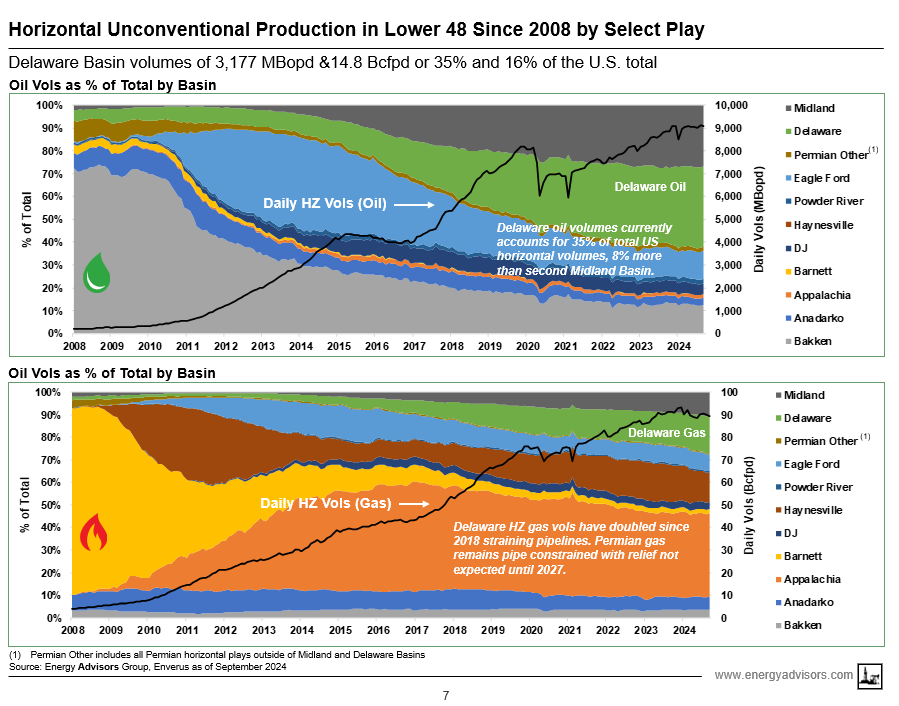

---- The Biggest Play. “The Delaware Basin is the largest producing Basin for oil and second largest for gas. Efficiencies are driving profits and volumes."

----- Inventory? "Operators are hungry for more inventory. At $45 oil, some say the Delaware has ~30,000 locations (~12 years) vs.~18,000 locations (~7.5 years) in the Midland.”

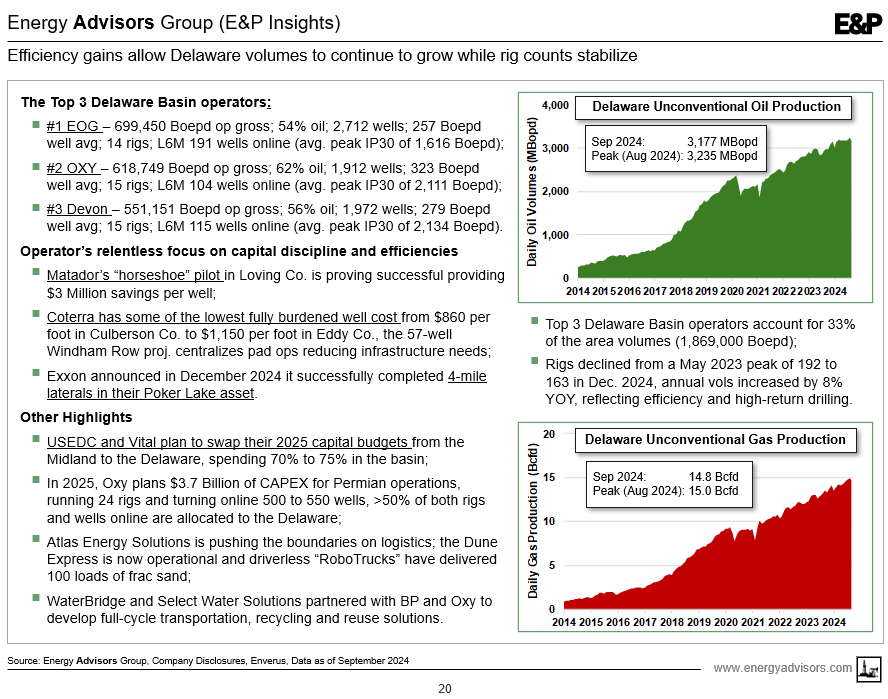

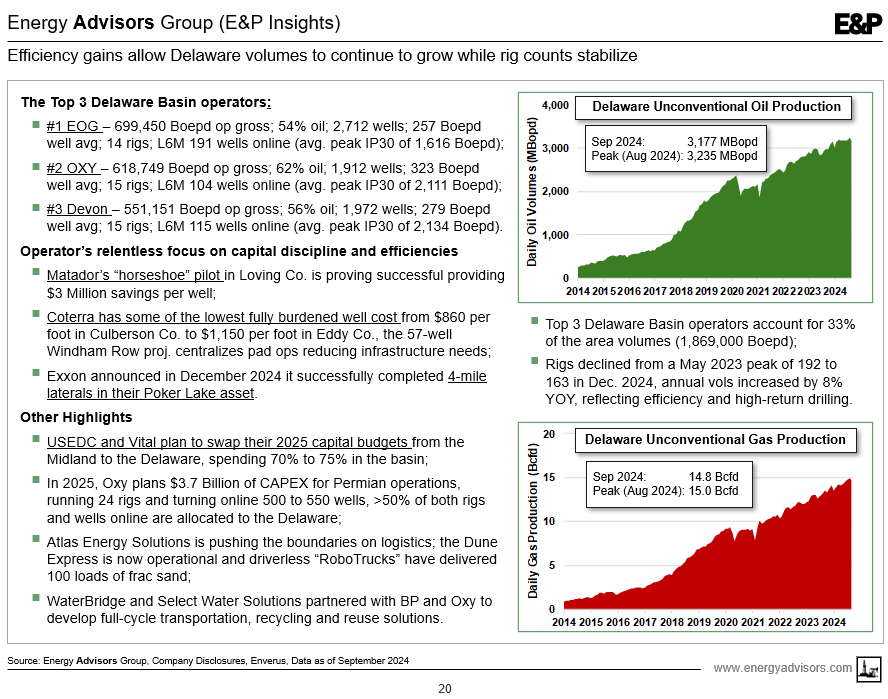

----- Efficiency: "Rigs declined from 192 in May 2023 to 160 by year-end while volumes increased by 8% YOY."

----- Deal Flow: "We expect increased M&A activity through 2025 as operators evaluate their newly acquired assets, ultimately divesting lower-tier assets to streamline their portfolio."

----- Gas Prices?: "Associated gas from the Permian is nearing 22 Bcfpd and is pipeline constrained. Wellhead gas prices are expected to continue to sell at significant discounts to HH through early 2027."

----- Operations: "Permian Resources is our spotlight Delaware company and has nearly tripled its acreage since July 2023 from 180,000 net acres to 450,000 currently."

Observations & Takeaways---

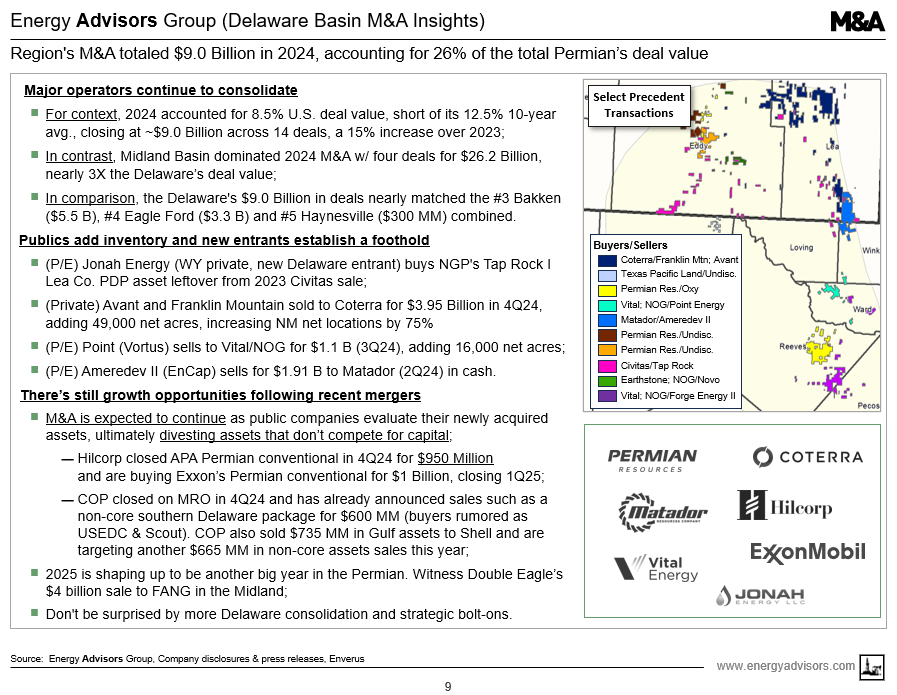

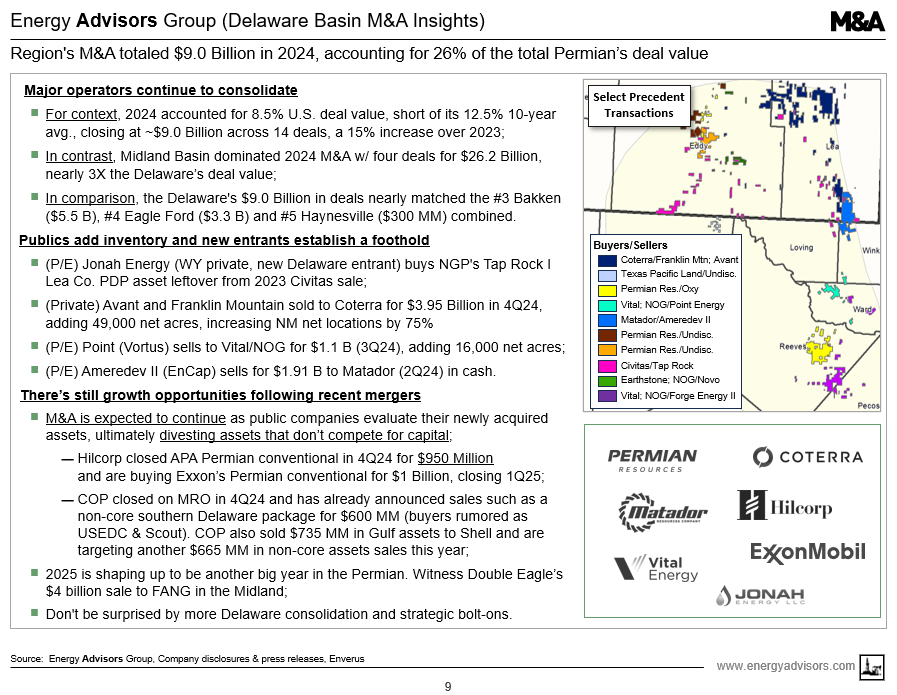

A&D – Totaled $9 billion in 2024

- 2024 M&A activity in the Delaware Basin totaled $9 billion, a 15% increase from 2023

- Public companies dominated acquisitions, buying 98% of the transactions ($8.8 Billion)

- 2025 Outlook: More strategic bolt-ons and asset swaps are expected, particularly from public operators refining portfolios.

E&P – Efficiencies, Sand Conveyer Belt, RoboTrucks, 4-Mile Lateral

- Top 3 operators (EOG, Oxy, Devon) produced 1.87 MMBoepd (~33% of Delaware Basin total)

- Lea and Eddy Counties (New Mexico) account for 58% of drilling rigs

- ExxonMobil drilled the first 4-mile laterals in Poker Lake

- Matador’s "horseshoe" well design in Lea County cut costs by 25%

- Atlas Energy Solutions' Dune Express sand conveyer system online and driverless "RoboTrucks" improve logistics

- At $45 oil, the Delaware has about 30,000 drilling locations (~12 years of inventory)

Capital Markets – P/E Reloading, Permian Resources (NYSE:PR) Outperforming, WAHA Gas Under Pressure

- Investors applaud Permian Resources' accretive A&D growth strategy with a 36% in last 2 years

- Private Equity (P/E) involvement is increasing

- P/E firms raised over $20B in 2024 (double the total from 2020-2023)

- P/E firms also sold $20B in assets and acquired $4.5B

- Dallas Fed surveyed 100 industry leaders predicting $71 WTI oil and $3.30 HH gas for 2025

- Permian gas (WAHA) prices are expected to remain under pressure until 2027, when new pipeline capacity comes online

Here is a second slide:

Here in a third slide:

In closing---

Energy Advisors is working hard to expand our thought leadership and look forward to providing additional market insight for our clients through regional perspectives, M&A analysis and market monitor.

Our firm has been serving the needs of buyers, sellers and capital providers for over thirty-five years.

TO LEARN MORE

Energy Advisors Group

Blake Dornak

Vice President

Phone: 713-600-0169

---Email: bdornak@energyadvisors.com

Brian Lidsky

Director

Phone: 713-600-0138

---Email: blidsky@energyadvisors.com

Corporate Office:

4265 San Felipe Ste 650

Houston TX 77027

Corporate Switchboard: 713-600-0123

DELAWARE BASIN REPORT - Vol 2

February 28, 2025; 48-Page Report

DELAWARE BASIN

M&A, E&P, Capital Markets, Operations

STACKED PAY. BONE SPRING & WOLFCAMP

>25,000-Horizontal Wells. 10,000 Verticals.

~160 RIGS RUNNING.

2,341-Drill Permits Issued Last 6 Months

1,885-DUCs Pending

Gross Production: 3.2 MMBopd & 14.8 Bcfpd

Delaware Reported $9 B in M&A, 8.5% Market

P/E Exits While Public Companies Buying

Report Incl List & Map of P/E & Private Cos.

DOWNLOAD THIS REGIONAL REPORT

STUDY 3002MA

Energy Advisors Group has released a review of the Delaware Basin as a continuation of our Market Monitor Series and thought leadership efforts. This 48-page Special Report provides unique perspectives on M&A, E&P and Capital Markets activity in the play. This report also includes a list of the remaining Delaware private and P/E backed companies with meaningful production as these companies dwindle in numbers by acquisitions from publics.

Here are our quick quotes, and takeaways from our report.

Quick Quotes:

---- The Biggest Play. “The Delaware Basin is the largest producing Basin for oil and second largest for gas. Efficiencies are driving profits and volumes."

----- Inventory? "Operators are hungry for more inventory. At $45 oil, some say the Delaware has ~30,000 locations (~12 years) vs.~18,000 locations (~7.5 years) in the Midland.”

----- Efficiency: "Rigs declined from 192 in May 2023 to 160 by year-end while volumes increased by 8% YOY."

----- Deal Flow: "We expect increased M&A activity through 2025 as operators evaluate their newly acquired assets, ultimately divesting lower-tier assets to streamline their portfolio."

----- Gas Prices?: "Associated gas from the Permian is nearing 22 Bcfpd and is pipeline constrained. Wellhead gas prices are expected to continue to sell at significant discounts to HH through early 2027."

----- Operations: "Permian Resources is our spotlight Delaware company and has nearly tripled its acreage since July 2023 from 180,000 net acres to 450,000 currently."

Observations & Takeaways---

A&D – Totaled $9 billion in 2024

- 2024 M&A activity in the Delaware Basin totaled $9 billion, a 15% increase from 2023

- Public companies dominated acquisitions, buying 98% of the transactions ($8.8 Billion)

- 2025 Outlook: More strategic bolt-ons and asset swaps are expected, particularly from public operators refining portfolios.

E&P – Efficiencies, Sand Conveyer Belt, RoboTrucks, 4-Mile Lateral

- Top 3 operators (EOG, Oxy, Devon) produced 1.87 MMBoepd (~33% of Delaware Basin total)

- Lea and Eddy Counties (New Mexico) account for 58% of drilling rigs

- ExxonMobil drilled the first 4-mile laterals in Poker Lake

- Matador’s "horseshoe" well design in Lea County cut costs by 25%

- Atlas Energy Solutions' Dune Express sand conveyer system online and driverless "RoboTrucks" improve logistics

- At $45 oil, the Delaware has about 30,000 drilling locations (~12 years of inventory)

Capital Markets – P/E Reloading, Permian Resources (NYSE:PR) Outperforming, WAHA Gas Under Pressure

- Investors applaud Permian Resources' accretive A&D growth strategy with a 36% in last 2 years

- Private Equity (P/E) involvement is increasing

- P/E firms raised over $20B in 2024 (double the total from 2020-2023)

- P/E firms also sold $20B in assets and acquired $4.5B

- Dallas Fed surveyed 100 industry leaders predicting $71 WTI oil and $3.30 HH gas for 2025

- Permian gas (WAHA) prices are expected to remain under pressure until 2027, when new pipeline capacity comes online

Here is a second slide:

Here in a third slide:

In closing---

Energy Advisors is working hard to expand our thought leadership and look forward to providing additional market insight for our clients through regional perspectives, M&A analysis and market monitor.

Our firm has been serving the needs of buyers, sellers and capital providers for over thirty-five years.

TO LEARN MORE

Energy Advisors Group

Blake Dornak

Vice President

Phone: 713-600-0169

---Email: bdornak@energyadvisors.com

Brian Lidsky

Director

Phone: 713-600-0138

---Email: blidsky@energyadvisors.com

Corporate Office:

4265 San Felipe Ste 650

Houston TX 77027

Corporate Switchboard: 713-600-0123